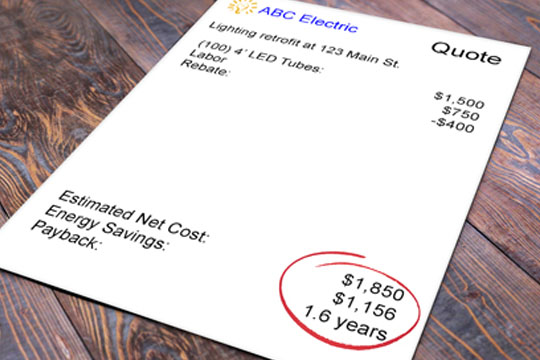

Rising electricity costs are once again pushing energy-efficiency to the forefront for commercial customers across the United States. According to data from the U.S. Energy Information Administration, average electricity rates for commercial customers increased by roughly 7% in 2025, with some regions experiencing increases as high as 29%. For building owners and operators, those increases are forcing a renewed look at operating costs and long-term energy savings.

Commercial lighting rebates have long helped offset energy costs by encouraging more efficient lighting systems. But with LED adoption now widespread, many in the industry are asking an important question: Are commercial lighting rebates still relevant in 2026?

The short answer is yes. While some programs have scaled back or adapted, most commercial lighting rebate programs are still available in 2026. In fact, higher incentive amounts, evolving program structures, and continued coverage across much of the country present meaningful opportunities for lighting upgrades this year.

The following trends are shaping the commercial lighting rebate landscape in 2026.

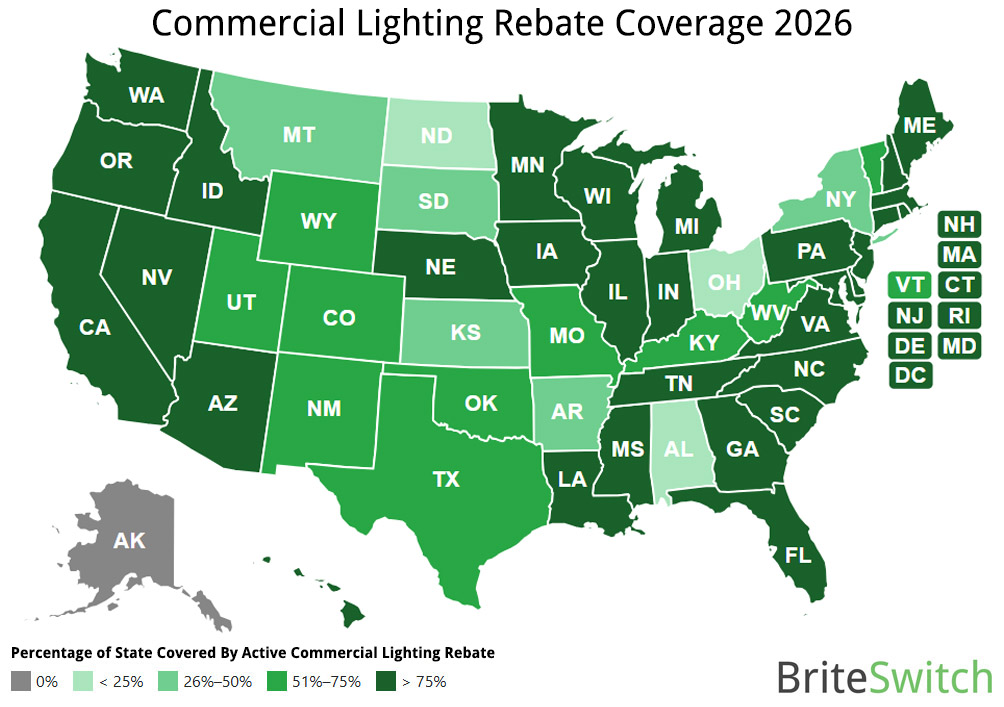

- 75% of the Country Is Covered by a Commercial Lighting Rebate

- Rebate Amounts Increased by 17% on Average

- Incentive Structures Shift Toward Energy Savings

- LED-to-LED Incentives Are Growing, But Still Limited

- Some Programs Sunset Incentives for Fluorescent Lighting Replacements

- Continued Focus on Lighting Controls

75% of the Country Is Covered by a Commercial Lighting Rebate

Currently, three-quarters of the United States has access to an active commercial lighting rebate program. While that coverage is down slightly from 77% last year, it still means the majority of the U.S. may qualify for some level of incentive.

One of the most notable changes for 2026 occurred in New York State. The New York Department of Public Service made the decision to sunset Commercial and Industrial (C&I) lighting incentives statewide at the end of 2025. As a result, New York now stands out as one of the few large markets without a traditional commercial lighting rebate offering (some control rebates are still available).

Despite isolated exits like this, overall coverage remains strong, reinforcing that lighting rebates continue to be a core energy-efficiency tool for most utilities.

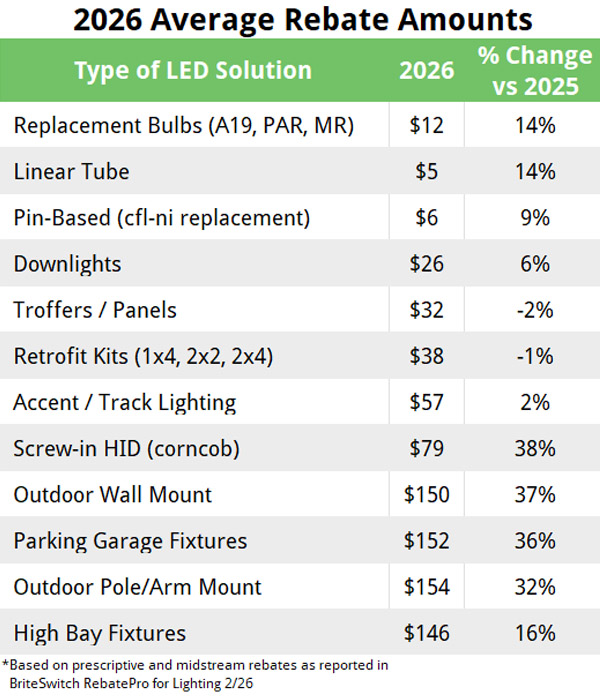

Rebate Amounts Increased by 17% on Average

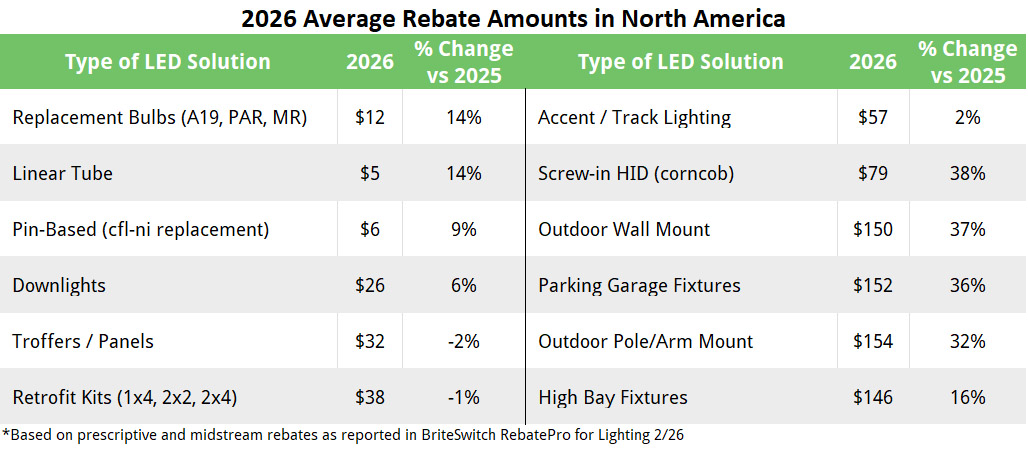

In 2026, the average prescriptive lighting incentive increased by a notable 17% across all categories. While nearly every product category saw some level of increase, the largest gains were concentrated in upgrades replacing legacy HID lighting.

Average Prescriptive Rebate in North America

Average Prescriptive Rebate in North America

Average Prescriptive Rebate in North America

Parking garages, canopies, wall packs, and outdoor pole lights all experienced incentive increases of 30% or more. Even straightforward and cost-effective upgrades, such as screw-in HID replacements, saw incentive increases as high as 38%.

These higher incentive levels are likely driven by a combination of rising equipment costs due to inflation and tariffs, increases in labor costs, as well as utilities’ growing urgency to reduce electrical consumption. By directing more rebate dollars toward projects with the highest energy-saving potential, utilities aim to maximize impact per dollar spent.

It is also worth noting that these figures do not include bonus programs. Bonus incentives, which can range from an additional 10% to double the standard rebate amount, are typically offered for a limited time. Historically, these programs tend to appear later in the year as utilities struggle to meet annual energy savings targets. In 2026, however, 7% of programs began the year with a bonus already in place, signaling continued pressure to drive early participation.

For lighting controls, incentives for simple controls like wall, remote, or fixture-mounted sensors increased by 12 to 20%.

See where these rebates are with RebatePro for Lighting

Incentive Structures Shift Toward Energy Savings

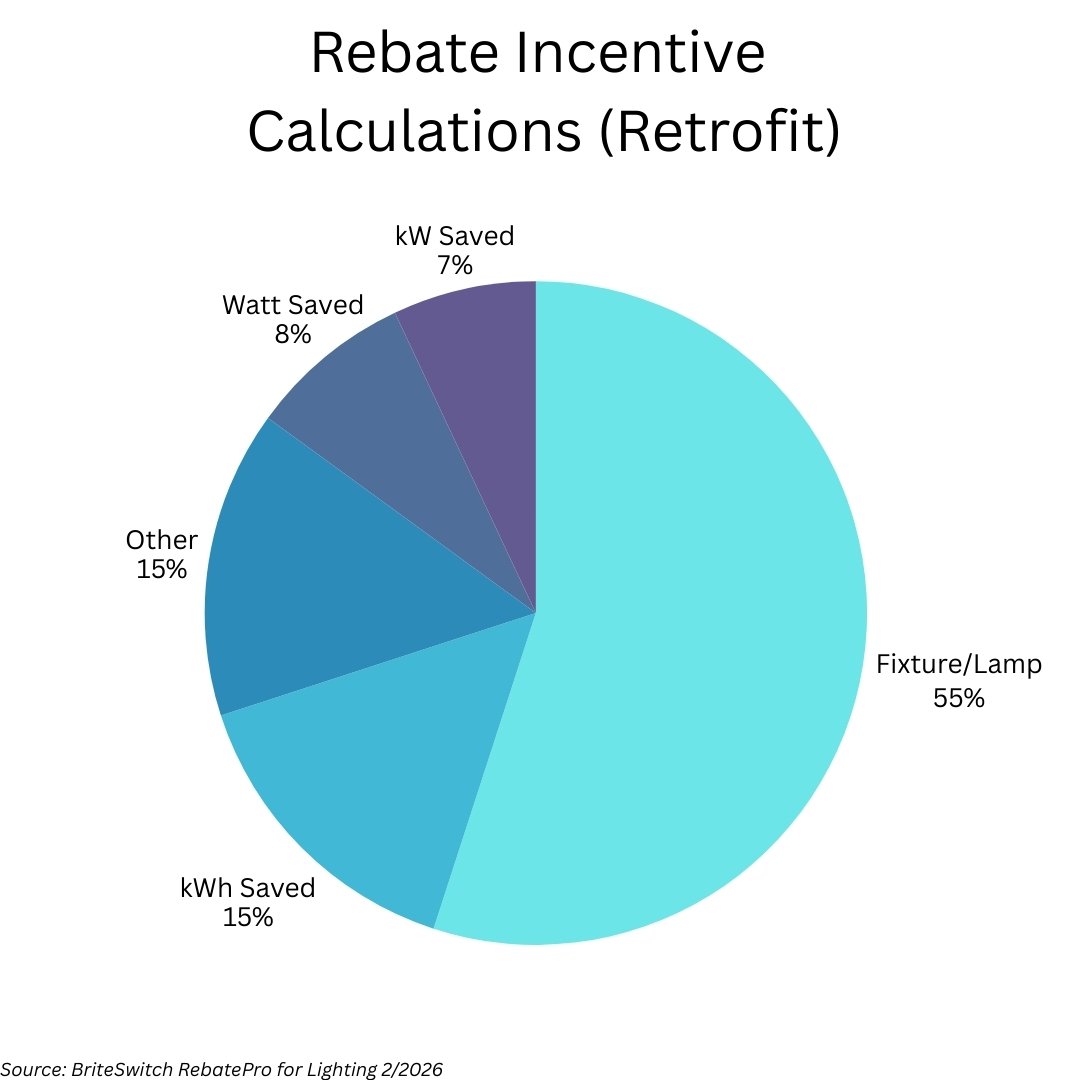

Beyond incentive amounts, program structures themselves are evolving to better reflect today’s market conditions. One of the more notable shifts in 2026 was a 6% move away from flat per-unit rebates (per lamp or per fixture) toward incentives based on energy savings, such as watts saved.

In the past, energy-savings-based incentives were often associated with custom rebates but many of these new calculated incentives are offered under prescriptive programs. That means extended review processes and formal measurement and verification studies are not required.

By tying incentives to watts saved, programs reward higher-efficiency solutions and encourage proper lighting design. This approach also creates opportunities for right-sizing lighting systems during retrofits, ensuring appropriate light levels rather than simply replacing fixtures one-for-one.

Despite this shift, roughly half of all lighting incentives are still structured on a per-unit basis. How quickly utilities continue moving toward savings-based models will be worth watching in the coming years.

LED-to-LED Incentives Are Growing, But Still Limited

As first-generation LED systems installed a decade or more ago approach end of life, customers are increasingly looking to replace them with newer, more efficient LED solutions. Advances in LED technology now allow some modern products to deliver up to 50% greater efficiency compared to early LED installations.

In response, 22% more programs in 2026 now explicitly allow rebates for LED-to-LED upgrades. While that growth is significant, programs that specifically call out LED-to-LED upgrades still represent a relatively small portion of the overall rebate market. Many programs that do not explicitly reference these upgrades may still offer incentives, particularly those based on energy savings. In these cases, eligibility typically requires direct confirmation with individual utilities.

Some Programs Sunset Incentives for Fluorescent Lighting Replacements

In 2026, several large, statewide rebate programs decided to sunset incentives for replacing fluorescent lighting. In most cases, these changes are tied directly to state-level regulations that restrict or prohibit the sale of linear fluorescent lamps.

Oregon, for example, implemented a fluorescent lamp ban in 2025, and its rebate programs now only offer incentives for linear lighting upgrades when paired with advanced lighting controls. Hawaii followed a similar path, with its lamp ban taking effect on January 1 and fluorescent incentives scheduled to sunset after March 31.

It is important to note that not every state with a fluorescent lamp ban has eliminated rebates for fluorescent replacements. States such as Maine and Colorado both have fluorescent bans in place, yet still offer incentives for fluorescent-to-LED upgrades. Customers in these areas may want to consider moving forward with upgrades sooner rather than later, as rebate programs can change while utilities adjust their offerings to meet current market conditions.

Continued Focus on Lighting Controls

One of the trends we saw in 2025 was an increased focus on lighting controls, and that trend has carried into 2026. While controls have always been part of energy-efficiency programs, they are now marketed much more actively and, in some cases, are even required in order to qualify for an incentive.

While the number of incentives for standard controls remained consistent, the number of rebates for Networked Lighting Controls (NLC) or Luminaire Level Lighting Controls (LLLC) increased by 7%. Programs have also worked to simplify incentive structures, with 63% of NLC incentives now offered through prescriptive programs and 40% are paid on a per-fixture basis, making them easier for customers and contractors to understand.

We’ve also seen more midstream programs add fixtures with integrated controls to their portfolios. Midstream programs are simplified offerings that run through participating electrical distributors and typically require little to no rebate paperwork for the end user. This approach allows utilities to capture smaller retrofit projects that historically may not have considered controls.

Lighting Rebates Continue to Play a Key Role in 2026

Commercial lighting rebates remain an important part of the energy-efficiency landscape in 2026 and continue to be a valuable tool for improving the return on investment for lighting upgrades. However, programs are clearly changing and evolving with the market. Incentive dollars are increasingly concentrated on higher-impact upgrades, program structures are shifting to reward energy savings, and support for mature lighting technologies continues to decline.

For electrical contractors, lighting manufacturers, distributors, and business owners, understanding where rebates are expanding, where they are being phased out, and how program rules are shifting is critical. In 2025 alone, we tracked 277 significant changes to rebate programs, underscoring the importance of staying current in an increasingly dynamic incentive landscape.

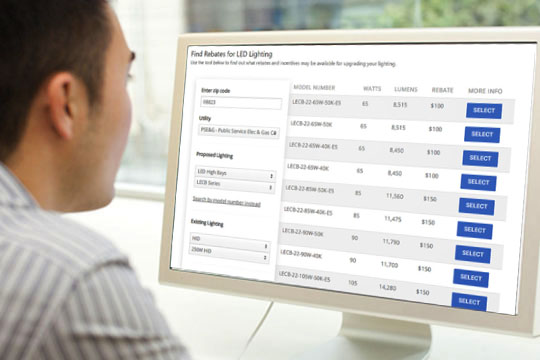

RebatePro for Lighting Makes It Easy

Need help taking advantage of the rebate market? RebatePro for Lighting contains virtually every commercial lighting rebate and incentive across North America. Whether you're part of a rebate processing team or a contractor looking to start using rebates as a sales tool, RebatePro for Lighting makes it easy. Quickly estimate the rebates for a project, find the best rebate areas in the country, or see where you have to become a trade ally to take advantage of the incentives.

Learn more about RebatePro for Lighting